As the chill of winter fades away, many people start dreaming of a spring vacation—an opportunity to unwind, explore new places, and enjoy the season’s vibrant beauty. However, without careful planning, a spring vacation can quickly become a financial burden. To ensure that your getaway is both enjoyable, debt free, and financially manageable, here are some practical tips for budgeting your spring vacation.

Set a Realistic Budget

The first step in planning a budget-friendly spring vacation is to establish a realistic budget. Consider all potential expenses, including travel, accommodation, meals, activities, and souvenirs. Be honest about what you can afford, and set spending limits for each category. A clear budget acts as a financial compass, guiding your spending decisions and helping you avoid overspending.

Choose an Affordable Destination

Selecting the right destination is crucial for a budget-friendly vacation. Opt for locations that offer good value for money, with affordable accommodation and activities. Consider visiting less touristy areas, where prices tend to be lower and crowds are smaller. Destinations with a favorable exchange rate can also help stretch your budget further.

Plan Your Travel Wisely

Travel costs can make up a significant portion of your vacation expenses, so it’s important to plan wisely. Book flights and accommodations well in advance to secure the best deals. Use comparison websites to find the cheapest options, and consider traveling during off-peak times to save on airfare and lodging. If possible, be flexible with your travel dates to take advantage of lower prices.

Consider Alternative Accommodations

Instead of staying in expensive hotels or resorts, explore alternative accommodation options such as vacation rentals, hostels, or bed-and-breakfasts. These options can offer more affordable rates and often provide unique and authentic experiences. Additionally, consider staying with friends or family if possible, as this can significantly reduce accommodation costs.

Be Strategic with Meals

Dining out can quickly add up, so be strategic with your meal planning. Choose accommodations that offer kitchen facilities, allowing you to prepare some of your meals. Visit local markets for fresh and affordable ingredients, and pack snacks for outings to avoid impulse purchases. When dining out, opt for lunch instead of dinner, as many restaurants offer cheaper lunch specials.

Prioritize Free and Low-Cost Activities

A spring vacation doesn’t have to be filled with costly attractions and activities. Prioritize free or low-cost options, such as hiking, visiting local parks, or exploring cultural sites. Many destinations offer free walking tours, festivals, or events that provide entertainment without breaking the bank. Research your destination in advance to uncover hidden gems and budget-friendly activities.

Use Public Transportation

Instead of renting a car or relying on taxis, use public transportation to get around. Buses, trains, and subways are often more affordable and can provide a unique way to experience the local culture. Consider purchasing a transportation pass for unlimited travel within a specific period, which can offer additional savings.

Plan for Souvenirs

Souvenirs can be a tempting expense, but they can also quickly add up. Set a specific budget for souvenirs and stick to it. Instead of buying expensive trinkets, look for meaningful and affordable keepsakes, such as local crafts, postcards, or artwork. Remember, the memories you create on your trip are the most valuable souvenirs of all.

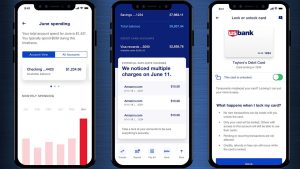

Monitor Your Spending

Throughout your vacation, keep track of your spending to ensure you stay within your budget. Use a budgeting app or a simple notebook to record your expenses and compare them against your initial plan. Regularly reviewing your spending can help you make informed decisions and adjust your plans if necessary.

Be Careful of Credit Card Usage

Overspending and impulse spending can be so enticing while a away on vacation, but you must fight the urge in order to maintain financial health after the vacation. Consider setting a daily spending limit and using cash or a debit card for everyday purchases to help curb impulsive spending. If you choose to use a credit card, ensure it’s for planned expenses that you can pay off immediately to avoid accruing interest. Remember, the goal is to return from your vacation refreshed with cherished memories, not a hefty credit card bill. By staying mindful of your spending habits, you can enjoy your trip without compromising your financial well-being.

Reflect and Adjust

After returning from your spring vacation, take time to reflect on your budgeting experience. Consider what worked well and what could be improved for future trips. Use these insights to refine your budgeting strategies and ensure that your next vacation is even more enjoyable and financially sound.

Conclusion

With thoughtful planning and strategic budgeting, you can enjoy a memorable spring vacation without letting it break the bank. By setting a realistic budget, choosing affordable destinations, and prioritizing cost-effective activities, you can create an enriching and enjoyable experience that aligns with your financial goals. Remember, the true value of a vacation lies in the experiences and memories you create, not the money spent. Embrace the beauty of spring and embark on your getaway with confidence and peace of mind.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.

Read the full article here